Specialists in the

Sale, Purchase, Rental and Valuation of Property

If you are considering selling, purchasing or renting we would be delighted to speak with you. We also provide a multitude of valuation services. As experienced valuers and property negotiators we will provide you with honest advice and excellent service to assist you in carrying out your property transaction. We pride ourselves in our attention to detail, established integrity and customer care that will not be surpassed.

Featured Property

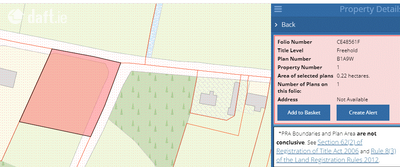

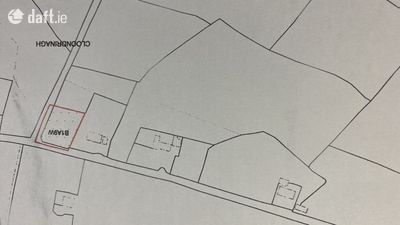

Arthur and Lees Estate Agents and Valuers are delighted to present for sale this 0.54 acre site. The site is located in Clondrinagh which is just outside the village of ...

What We Do

We Can Take Care Of All Your Property Needs

Email Us: info@arthurandlees.ie

Call us: +353 (0)65 68 68686