Variable interest rates charged by Irish financial outlets ‘excessive’, says Brian Hayes

Variable interest rates charged by Irish financial outlets ‘excessive’, says Brian Hayes

“Excessive” variable mortgage interest rates being charged by banks in Ireland, should be investigated by the Competition and Consumer Protection Commission, Dublin MEP Brian Hayes has said.

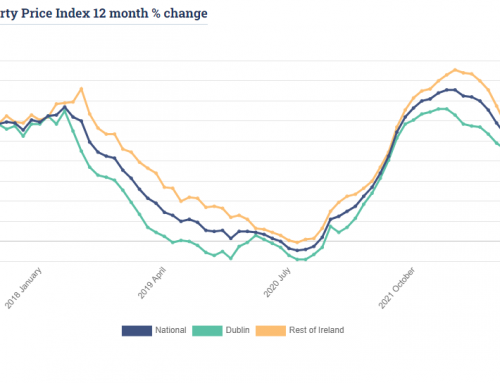

Central Bank data published recently showed the average rate of standard variable mortgages in Ireland was 4.26 per cent, well above the 0.05 per cent rate charged by the European Central Bank.

“We can now say with certainty that Irish homebuyers are being ripped off by banks, particularly when you consider the euro zone average variable mortgage rate which is 2.47 per cent,” Mr Hayes said.

“It is welcome that the Central Bank has finally published the true average variable rate in Ireland. Up until recently, the variable figures that the Central Bank provided were distorted by the inclusion of ultra-low interest rate tracker mortgages which have been restructured.”

Mr Hayes said the Competition and Consumer Protection Commission, set up in October 2014 from the merger of the Competition Authority and the National Consumer Agency, should investigate the rates being charged.

“There should be a thorough investigation into the arguments that current standard variable rates do not reflect market conditions,” he said.

“ECB interest rates are at an all-time low of 0.05 per cent. This low interest rate environment has been reflected in many euro zone countries through lower variable rates but in Ireland banks are still comfortable offering variable rates of over 4 per cent.”

Ireland’s largest banks have told the Oireachtas Joint Finance Committee that home loan rates here are more expensive than in other EU countries because of a higher cost of funding and the effects of tracker mortgages.

Mr Hayes said “radical change” of the current Irish mortgage system was needed.

From: Ciarán Hancock – http://www.irishtimes.com