An Irish Times article a few months back (Time to review your house insurance) covered a lot of points and pitfalls in regard to house insurance. However, I’m somewhat in the dark in regard to assessing the adequacy of my own house insurance, particularly in a worst-case scenario of a total rebuild.

Our Dublin house is a mid-1960s-design semi-detached house with garage. It is generally reflective of the building standards of that era, with some modest heating and insulation improvements over the years. Building regulations and standards have vastly improved in the interim and are about to go through yet another revision to accommodate the new environmental standards.

In the case of a total rebuild – and this is the level of insurance I feel should be provided for – how should I go about providing adequately for this at my next renewal?

Your question sheds light on a number of important issues. Firstly, reinstatement costs to rebuild your property must take account of current building regulations, which are constantly changing. In the unfortunate event that your property is destroyed, the new building must meet the standards that are in place at the time of rebuilding.

Secondly, the amount your home is insured for should be calculated on a “total loss” scenario. This assumes that the house is destroyed, has to be demolished, the site cleared and then completely rebuilt. The amount should allow for complete replacement of the house, footpaths, parking areas and fencing and should include VAT.

As well as the cost of rebuilding, the reinstatement value must also cover professional fees such as those of a chartered building surveyor, or architect’s fees that detail the replacement property and apply for planning permission. Engineers’ fees to design new structural elements should also be covered, as should fees for a chartered quantity surveyor to control the rebuilding costs. There will also be a requirement to appoint an assigned certifier under the building regulations and a project supervisor for the design process under health and safety legislation.

You describe your property as a typical 1960s semi-detached house with garage in Dublin. Where properties are straight-forward and are built after 1960, I suggest that you use the Society of Chartered Surveyors Guide to House Rebuilding Costs for Insurance Purposes. This guide is intended to assist you in insuring your home and briefly explains the more important aspects of house insurance. It also emphasises the importance of adequately insuring what is probably your most valuable asset.

Calculating amount

The SCSI website also has a “ready reckoner” table to assist in calculating the correct amount for typical houses in various parts of the country. The figures shown in the table are a minimum base cost guide for your house insurance. The figures assume a standard quality specification with normal foundations, timber frames or brick/block walls, concrete tiled roof, concrete ground floor and timber first floor, softwood flush doors and double-glazed windows, painted plaster to walls, plastered ceilings, standard electrics and heating to include insulation, air-tight construction, heat recovery and heat pump to latest BER ratings.

The sum insured should be increased if you have better-than-average kitchen fittings, built-in wardrobes, enhanced finishes and any other items not normally included in an estate-type house.

For more historic houses or bespoke properties, the tables should not be used and instead a reinstatement valuation should be prepared by a chartered surveyor.

Remember that home insurance policies differ, some covering more than others. It is therefore important to examine your policy very carefully to make sure you are insuring for the correct amount. To find a local chartered surveyor who can assist on this matter, use the “find an expert” search at scsi.ie

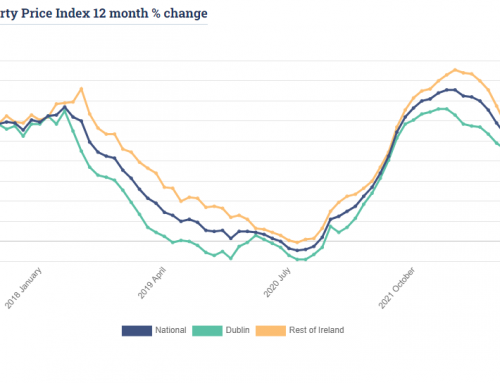

With building cost inflation running at an average of 6.5 per cent over the past 18 months, it is important to make sure that your reinstatement valuation is correct. Remember also that the market value of your property has no bearing on the level of house insurance required.

We all take out insurance and hope that we never have to use it. If that awful day does come however, make sure that you are well prepared. – Noel Larkin

Noel Larkin is a chartered building surveyor and a member of the Society of Chartered Surveyors Ireland, scsi.ie

Source: The Irish Times, 9th March 2021