IPAV BAROMETER – PROPERTY PRICES RISE FURTHER IN LATTER HALF OF 2024

Housing Policy Needs Specialist Intervention

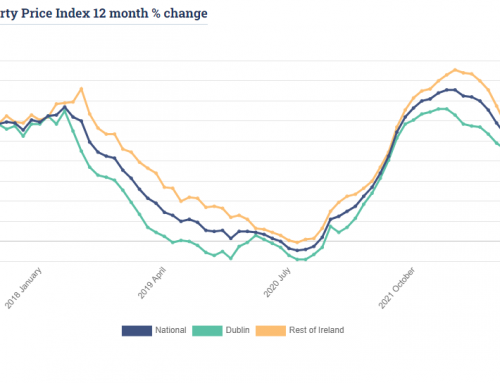

IPAV’s twice yearly Residential Property Price Barometer published today (Sunday) has found that while the overall price increase for the latter six months of 2023 was 2.99%, up from 2.05% in the previous six months, there are increases right across the country in the 5% to 7% range.

Lower increases of the order of 1% were seen in many Dublin areas where prices are at the higher end or where supply has increased beyond the norm, and this has served to bring the overall increase in the latter six months to 2.99%.

In the entire Barometer there were just two negative figures, in Dublin 6 and Wicklow, in the four-bedroom category and these were 0.23% and 0.09% respectively.

IPAV’s Residential Property Price Barometer charts prices actually achieved by auctioneers for three and four bedroom houses and two-bedroom apartments, and has proven itself to be a very reliable data source.

Commenting, Pat Davitt, IPAV’s Chief Executive said: “Despite the substantial increases of recent years,’ prices remain resilient and given the paucity of supply, it’s not unreasonable to think that, barring a geo political crisis or unforeseen catastrophe, we could see rises of the order of 5% this year.”

He said auctioneers continue to report a scarcity of supply with strong demand, including from non-Irish nationals and returning emigrants.

“At 32,695 new builds in 2023 we’re finally getting very close to an historical and outdated target of 33,000 homes per year, with some estimates suggesting the target should be revised upwards to over 60,000 a year,” he said.

And he pointed to CSO data which shows that between the 2016 census and the latest one in 2022 housing stock has risen by 5% but the population has grown by 8%, with some counties having a much greater divergence. The latest census from April 2022 put the population at 5.2 million and it has grown by 100,000 in the last year alone.

Mr Davitt said there are worrying signs for the year ahead that could seriously exacerbate supply in both sales and rental. A Sherry Fitzgerald study found just 11,050 second-hand properties listed for sale nationally in January, a mere 0.6% of the entire private housing stock; a 27% drop on the previous January and a startling 46% decline on January 2020.

BNP Paribas has described 2022 as a dismal year for the Irish investment property market with turnover down almost 70%.

“Private landlords have been haemorrhaging from the market since IPAV first identified the issue almost six years ago,” he said.

In terms of solutions he said we need a combination of coordinated measures to fix the market, from planning to revisiting Rent Pressure Zone rules where they are incapacitating the market; to supporting SME builders with low cost finance; giving meaningful incentives to new and existing landlords; to bringing far more vacant and derelict properties back into use; to providing longer term mortgages, where appropriate, and improving the mortgage lending limits.

“We need a series of complementary measures working in harmony, rather than isolated and divergent policies with the immobilising baggage of unintended consequences,” he said. “And that’s going to need some kind of specialist intervention not seen heretofore,” he concluded.

Article – The Institute of Professional Auctioneers and Valuers (IPAV)