A REPORT INTO the private rental sector in Ireland has recommended an improvement in the tax treatment for landlords, with a case made to link such tax breaks to providing more secure tenancies.

Taoiseach Leo Varadkar brought the report from the National Economic and Social Council (NESC) to Cabinet yesterday.

The body advises the Taoiseach and the Government on strategic policy issues.

It is understood the report will now feed into future reviews of Government housing policy.

Senior Government sources have said they are in favour of such tax changes for landlords, however, it is understood there is no consensus on the issue within Cabinet.

The report into the private rental sector, which is due to be published today, makes recommendations in three areas.

It states that “the improved tax treatment of rental income for private landlords could be introduced and there is a case for linking this to more secure occupancy for tenants”.

It also makes recommendations regarding vacant property, stating that a potential source of additional rental property is vacant and derelict property.

The report also notes that Ireland’s existing Rent Pressure Zones were recently extended until the end of 2024.

It found that consideration should be given to the question as to whether there is sufficient market sensitivity in Ireland’s model of rent control in situations where rents have fallen substantially below the market level.

The report also notes the major shift towards rental and away from home ownership in Ireland and sets out a clear economic assessment of the continuing rationale for ownership.

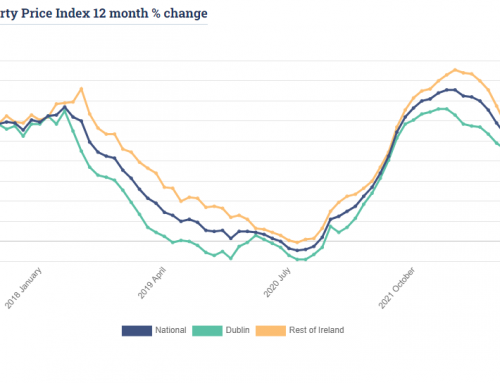

Home ownership rates among young working adults in Ireland have collapsed in the face of rising house prices, according to a report last year by the Economic and Social Research Institute (ESRI).

It found that the share of 25-34 year olds who own their own home more than halved between 2004 and 2019, falling from 60% to just 27%.

The NESC report noted by Government yesterday also highlights the potential to reduce the need for individuals to become homeowners by continuing reforms of the existing rental sector and efforts to drastically grow the alternative non-market rental sector.

Another source stated that there was much discussion about the issue of tax breaks before the last budget and any major tax reforms did not come to pass.

They added that it was very much an issue that is in the court of the Department of Finance but that there’s no signal yet that there any plans to change the tax treatment in the short-term.

The recommendations come ahead of a Government decision on whether to extend the eviction ban which is due to come to an end in April. Cabinet are also set to sign off on a number of measures next week to deal with the cost-of-living.

Housing Minister Darragh O’Brien previously told The Journal that the tax treatment of small landlords has to be revisited.

He said that if landlords are going to remain in the market then the tax treatment would have be discussed again by Government. Taoiseach Leo Varadkar also stated prior to the budget last year that introducing some tax changes in the budget to encourage landlords to stay renting and stay in the market is a “good idea”.

Speaking on RTÉ’s Upfront programme Minister of State at the Department of Finance Niall Collins said this week that the tax code for landlords is something that is being reviewed as part of the budgetary process with indications that despite concerns that budget day is a long while off any tax changes might have to wait until autumn.

Article by Christina Finn – Journal.ie