Rents being sought on the open market in the final three months of 2022 were 13.7% higher than the same period in the prior year, the latest rental report from the property website Daft.ie shows.

At €1,733 per month, the average rent at the end of last year was 126% higher than the low point of €765 in late 2011.

The increase over the third quarter of last year was of the order of 2.7%.

Rental inflation is being driven primarily by a lack of supply of rental properties.

The report refers to the private rental market as being “chronically starved” of homes, a situation which it says shows no signs of abating.

Nationwide, there were just 1,096 homes available to rent on February 1, down over 20% on the same date a year ago.

“That figure from 2022 was itself a complete outlier in a series that stretches back to 2006,” Ronan Lyons, Associate Professor of Economics at Trinity College Dublin and author of the Daft Report said.

“Between 2015 and 2019, a time when supply was very weak relative to demand – pulling up rents – there were typically 3,800 homes available to rent at the start of February.

“The average for February 1 over the full period 2006-2021 was 8,500. This hopefully puts into context just how bad things are if there are only 1,100 homes on the market,” he explained.

The supply of new rental properties was the only real solution to the shortage of rental homes, he said.

Muted inflation for sitting tenants

The report includes an index of rents being paid by sitting tenants which shows that the rate of rental inflation in that sector was a more modest 3.8% over the year.

“Since the introduction of Rent Pressure Zones in 2016, rents of sitting tenants have increased by 19% on average, compared to an average increase in open-market rents of nearly 75% over the same period,” the report notes.

In Rent Pressure Zones (RPZ), rental increases cannot exceed general inflation, as recorded by Harmonised Index of the Consumer Price, or 2% per year pro rata, whichever is lower.

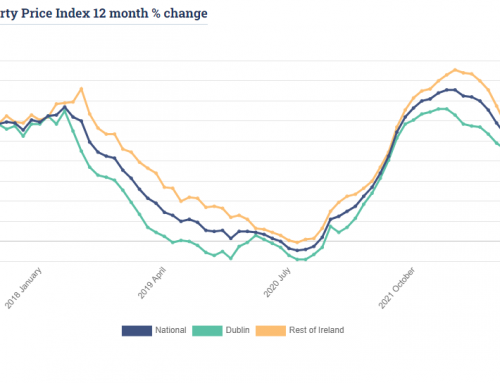

All parts of the country are experiencing substantial year-on-year open market rent increases, albeit with regional differences, the report shows.

Throughout 2022, the rate of inflation in Dublin was 13.1% while in Cork City it was 14.9% bringing average rents in each city to €2,324 and €1,768 respectively.

In Limerick, the rate of rental inflation registered at 18.9% and Waterford City, it was just over 20%.

Outside the cities, the average annual increase in market rents was 13.6% bringing the average rent outside of the main cities to €1,318.

“Housing has established itself as the dominant political issue in recent years. While much of the policy effort is focused on homeownership, a variety of demographic trends, including delayed family formation and increased longevity, have contributed to a growing diversity in living arrangements,” Ronan Lyons said.

“This in turn will mean more homes in the rental sector and thus a more tenure-neutral housing policy is required,” he concluded.

Ronan Lyons said that since society reopened after Covid there had been a “phenomenal” increase in demand and a reduction of stock of rental homes.

The only solution is to build more rental homes, he stated.

“But that unfortunately is only happening in a very limited scale in Dublin at the moment. And even now bizarrely, policy seems to be moving away from supporting the construction of rental homes. This is not an either or, this is about building all types of homes,” he added.

Speaking on RTÉ’s Morning Ireland programme, Mr Lyons said that increasing rental stock to meet demand is “probably a ten year task”, and up to a quarter of a million homes are needed to control prices.

He estimated that the country is short by between 200,000 and 250,000 rental homes based on the patterns that has been seen over the last 20 years or so.

Meanwhile, the Institute of Professional Auctioneers & Valuers has repeated its call for the abolition of the Rent Pressure Zone legislation.

The rules limit increases in rental prices in sitting tenancies in certain parts of the country to the rate of general inflation or 2%, whichever is lower.

Although it appears to be successfully keeping a cap rental inflation in sitting tenancies, IPAV agues that it is driving up open market rents and accelerating the exit of private landlords from the market.

Article by – Brian Finn – www.rte.ie/news/business