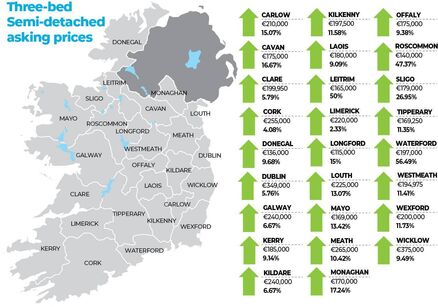

Reports from Daft.ie and Myhome.ie show no let-up for the squeezed housing market

Average price: €227,645

Year-on-year change: 17.9%

Average price: €221,098

Year-on-year change: 8.2%

Average price: €240,655

Year-on-year change: 7.6%

Average price: €239,555

Year-on-year change: 14.5%

Average price: €263,789

Year-on-year change: 12.3%

Average price: €318,380

Year-on-year change: 3.9%

Average price: €216,812

Year-on-year change: 14.3%

Average price: €283,336

Year-on-year change: 16.4%

Average price: €218,866

Year-on-year change: 9.3%

The surging cost of building materials could prove a challenge for the delivery of new home projects, Conall Mac Coille, chief economist at Davy said.

He was referring to the 18% rise in the cost of vital building materials which could threaten the viability of housing projects that are key to addressing the severe shortage in homes throughout the country.

Mr Mac Coille said: “The broad picture of the market in early 2022 remains similar to last year — impaired supply coupled with robust demand due to Ireland’s strong labour market.

He said that homes are being sold at 6.5% above asking prices, reflecting the froth in the market, and that one-fifth of homebuyers who secure mortgage approval are now failing to secure a property.

While the number of new homes starting construction has reached record levels, there are fears that the soaring cost of building materials could impact the time it takes for them to come to market.

Construction industry sources have said the surging price for materials and the difficulty in sourcing some products pose a real risk to the State’s target of building between 30,000 and 35,000 homes each year.

“CSO data on building materials inflation was 18% in February, posing a viability challenge for many development projects in the pipeline,” said Mr Mac Coille.

Speaking to the Irish Examiner on inflation, Conor O’Connell, director of the Construction Industry Federation for the southern region, said:

“We’re currently engaging with several Government departments on the extraordinary cost inflation in the industry and we won’t be commenting further until we have concluded those discussions.”

Mr Mac Coille said there were signs for optimism in new instructions data, even though that was still running well behind pre-pandemic figures:

One chink of light is that new instructions to sell of 7,500 in the first 11 weeks of 2022 are well up from 4,800 in 2021, albeit still below the 9,250 in 2019.

Daft.ie’s quarterly report painted a similar picture with the average listed price of a home nationwide now at €299,093, up 8.4% on the same period in 2021.

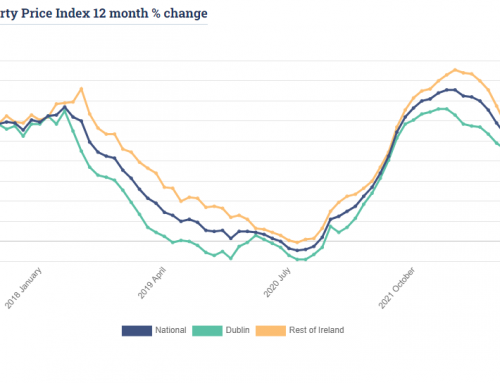

Increases remain smaller in urban areas, compared to rural areas, although the gap is narrowing. In Dublin, Cork, and Galway cities, prices in the first quarter of 2022 were roughly 4% higher on average than a year previously, while in Limerick and Waterford cities, the increases were 7.6% and 9.3% respectively.

Speaking on the Daft.ie report, economist Ronan Lyons said prices have increased quarter-on-quarter nationally for seven consecutive quarters since early 2020 when the impacts of the Covid-19 pandemic were first felt.

“If Covid-19 has done anything to the housing market in Ireland, it has been to take a shortage that was concentrated in urban areas and spread it all across the country,” he said.

Both new and secondhand supply remain weaker than expected before the pandemic. Combined with unexpected strong demand, due to accidental savings during lockdown, this has driven up prices.

“Additional supply — of all types of homes, for sale but also market rental and social rental housing — remains the only real solution to solving Ireland’s chronic housing shortage.”

Article by Alan Healy – Irish Examiner