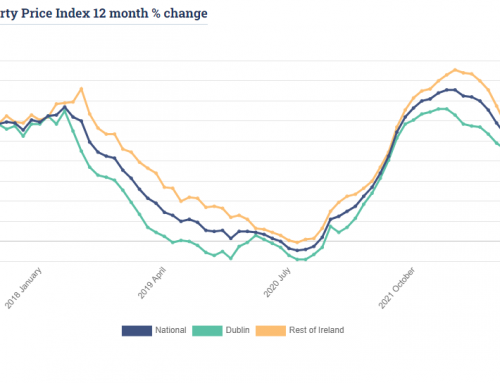

Residential property prices increased by 12.4 per cent nationally in the year to September, according to the latest data from the Central Statistics Office (CSO).

This compares to an increase of 10.9 per cent in the year to August and a decrease of 0.8 per cent in the 12 months to September 2020.

In Dublin, residential property prices saw an increase of 11.5 per cent in the year to September, while property prices outside Dublin were 13.2 per cent higher.

In the capital, house prices increased by 12.4 per cent and apartment prices increased by 7.7 per cent. The highest house price growth in Dublin was in the city at 14.1 per cent, while Fingal saw a rise of 8.6 per cent.

Outside Dublin, house prices were up by 13 per cent and apartment prices up by 15.1 per cent. The region outside of Dublin that saw the largest rise in house prices was the Border, at 21.9 per cent. At the other end of the scale, the Mid-East saw a 10.7 per cent rise.

Overall, the national index is 7.4 per cent lower than its highest level in 2007. Dublin residential property prices are 13.8 per cent lower than their February 2007 peak, while prices in the rest of Ireland are 9.5 per cent lower than their May 2007 peak.

Association of Irish Mortgage Advisors chairman Trevor Grant said both rents and property prices are rising “month in, month out”.

“People trying-to-be-homeowners with good incomes and steady jobs all over the country are getting frustrated and disillusioned because they are finding themselves stuck between a rock and a hard place,” he said.

“Unlike the austerity years, banks have money to lend and want to lend, but the culmination of lack of supply, high property prices, tight lending rules, soaring rents and in some cases, expensive childcare, is hampering people’s ambitions to own their own home.

“Work needs to be done in every aspect to remove or substantially reduce the impact of these roadblocks, by way of a cohesive and holistic plan devised by all relevant stakeholders.”

Property prices nationally have increased by 106.5 per cent from their trough in early 2013.

Dublin residential property prices have risen 113.5 per cent from their February 2012 low, whilst residential property prices in the rest of Ireland are 108.2 per cent higher than at the lowest point, which was in May 2013.

New and existing dwellings

Prices of new dwellings in the third quarter were 3.3 per cent higher than in the corresponding quarter of 2020. This compares to an increase of 2.2 per cent in the year to the second quarter.

Prices of existing dwellings in the third quarter were 13 per cent higher than in corresponding quarter of 2020. This compares to an increase of 6.7 per cent in the year to the second quarter.

Overall, prices of new dwellings have risen by 77.2 per cent from their trough in the middle of 2013. Prices of existing dwellings are now 105.8 per cent higher than at their trough in 2012.

In September, 4,304 dwelling purchases by households at market prices were filed with Revenue.

This represents a 34.8 per cent increase compared to the 3,193 purchases in September 2020 and a 14.3 per cent increase compared with the 3,764 purchases in August 2021. The total value of transactions filed in September was €1.5 billion.

Households paid a median price of €272,000 for a dwelling on the residential property market in the 12 months to September.

The Dublin region had the highest (€400,000) in the year to September. Within the Dublin region, Dún Laoghaire-Rathdown had the highest median price (€570,000), while South Dublin had the lowest (€368,500).

The highest median prices outside of Dublin were in Wicklow (€375,000) and Kildare (€332,249), while the lowest price was €125,000 in Leitrim.

Mr Grant said buying a home has become a “challenging business”, with prospective home buyers “acutely aware” of the need to have their mortgage approval in place before they even look in an estate agent’s window.

“An increasing number are seeking the advice of mortgage brokers to review their mortgage market options and to access a range of new lower cost mortgage options from non-bank broker distribution lenders,” he added.

Rachel McGovern, director of financial services at Brokers Ireland, said: “While prices continue to rise and are now firmly in double digit growth almost everywhere, the level of increase has slowed slightly month-on-month in September.

“This slight tapering of the level of increase may indicate that prices have peaked for now. However, we are still in a very difficult market with a severe lack of supply, which is impacting affordability.”

Article by Colin Gleeson – Irish Times